Donald Trump

Here is the world's grip on Trump

Andreas Cervenka

Reporter and economic commentator

This is a commentary text. Analysis and positions are those of the writer.

Updated 11.24 | Published 08.39

In a few weeks, Donald Trump has turned the world order that has been in place since World War II upside down.

The demands on other countries are many, but there is also something that the US needs from the world, namely money.

Will Europe want to finance a country that acts like an enemy?

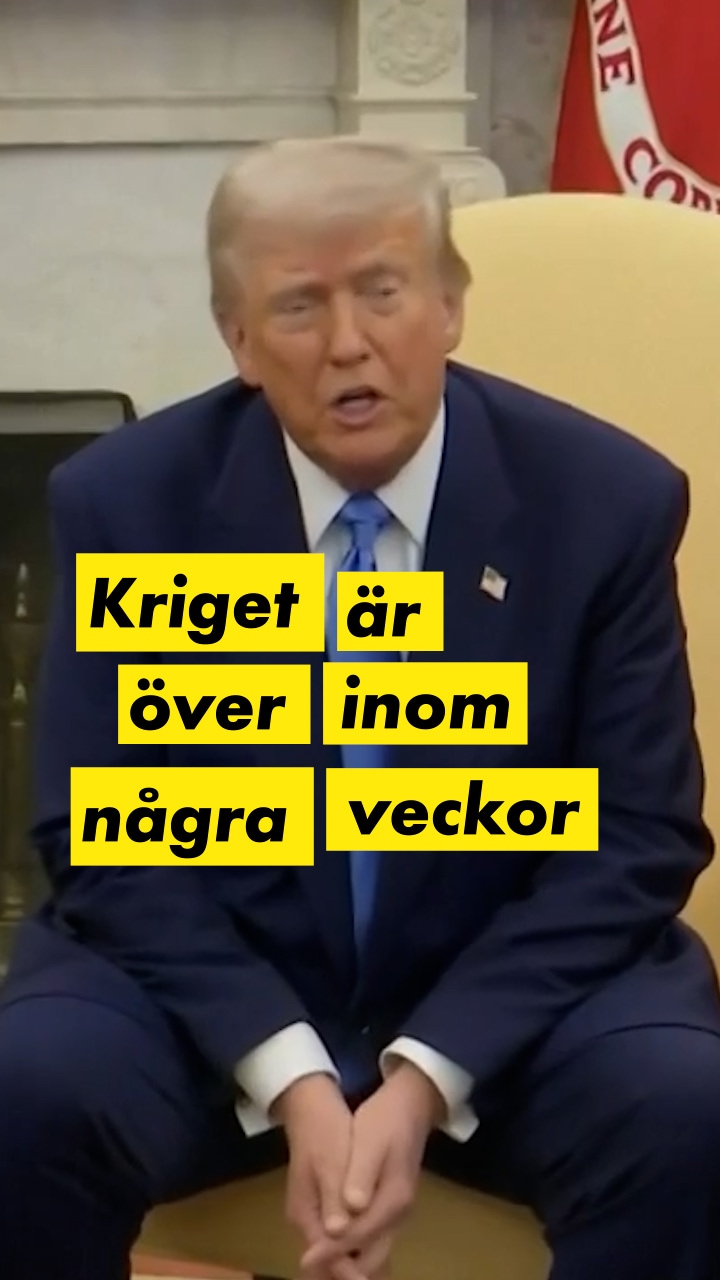

Trump: "The war will be over in a few weeks"

0:26

Donald Trump is largely indifferent to the fate of Europe, stated Friedrich Merz, who looks set to become the new Chancellor of Germany after Sunday's election.

That is a diplomatic way of putting it.

“The US has become a threat to Sweden’s security,” wrote Patrik Kronqvist, political editor of Expressen this weekend.

A sentence that a few months ago would have been perceived as crazy, but which now appears as a sober analysis of the situation.

With his demands for Ukraine to hand over a large part of its natural resources, the threats against Denmark and Canada to cede Greenland and be incorporated into the US, respectively, Donald Trump has reintroduced the concept of colonialism.

As the former head of the British intelligence service MI6 Alex Younger summarized in a well-received interview with the British Newsnight, we are in a new era where rules and norms are passé and where “strong men” make “deals”.

Does Europe need the US more than the US needs Europe? Perhaps, but that does not mean that the US is self-sufficient in all areas – far from it.

The sore point is the country's chronic budget deficit – something that Donald Trump's sidekick Elon Musk is set to fix via his quasi-department DOGE.

Here's the math:

According to data from the US Treasury Department, the US's total national debt is over $36 trillion, or about 120 percent of US GDP.

Who owns these debts?

One-fifth, about $7.3 trillion, has been borrowed by the US itself in the form of US government securities held in the social security systems Social Security and Medicare.

In addition, the Federal Reserve holds bonds worth just over $4.25 trillion, according to recent statistics.

That leaves around $24.7 trillion.

Two-thirds of these debts are owned by US funds, banks and private individuals.

A third, or about $8.5 trillion, was owned by foreign investors at the end of the year.

The largest creditor is Japan with $1.06 trillion, followed by China with $760 billion and the United Kingdom with $723 billion.

These government securities are not owned by governments, although central banks often hold large holdings, but are held by everything from large corporations to banks, funds and pension companies.

In the past, it has often been said that China has a hold on the United States in the form of a large holding of American debt securities.

But compared to China, Europe is significantly more important. In total, the United States has borrowed at least $2.7 trillion from investors in Europe, according to figures from the Treasury Department.

This indirectly constitutes a means of pressure.

In the coming years, the US will have enormous borrowing needs.

According to the Congressional Budget Office (CBO), the US government will run a deficit of $1.9 trillion this year and $1.7 trillion next year.

These figures should be compared to the fact that Elon Musk's DOGE claims to have found savings of $55 billion so far, which is not even change in this context.

According to the CBO, the US will need to borrow an additional $24 trillion by 2035, in addition to rolling over existing debts. These are staggering sums.

Who will pay for the money? Well, judging by the pattern so far, a third or $8 trillion will come from foreign investors and around $2.6 trillion from Europe.

Is it reasonable if the US also becomes a security threat?

Europe has its own problems with high public debt, and countries need to borrow more to finance a rapid military buildup because the US is no longer seen as trustworthy.

The US's runaway national debt has been a topic of discussion for years. So far, it has not diminished the willingness to lend to the country.

But as Mark Sobel, formerly of the US Treasury, tells the Financial Times: The debt can be financed, until it can no longer.

Just the suggestion from European politicians that the continent's banks and institutions should not buy more US government securities or even sell their holdings would be enough to cause interest rates to soar and the ground to shake under the market.

Donald Trump's government would end up in crisis.

This is actually an insane idea and of course risks backfiring on the European economy in the short term.

But for those who missed it: We now live in an insane world.

Anyone who wants to get “strong men” to listen may have to learn to speak the language of “strong men”.

Inga kommentarer:

Skicka en kommentar