Gold

Russia and China buy gold - biggest increase in 55 years

Of:

Elmer Rikner

Published: Less than 3 hours ago

Vladimir Putin.

Vladimir Putin. Photo: Konstantin Zavrazhin / AP

NEWS

There is a gold rush on the world market.

Not since 1967 have countries around the world invested as much in the precious metal as now.

According to analysts, two countries are primarily responsible for the increase - China and Russia.

The last time the world bought this much gold was 1967, writes the Financial Times.Then European central banks bought so much gold from the US that the price skyrocketed and the London Gold Pool of Reserves crashed. Something that changed the global world market.

But now the analysts believe that several countries want to transfer their national reserves from the dollar in favor of gold.

- It could suggest that the geopolitical situation has led to mistrust, doubt and uncertainty, says Adrian Ash, head of BullionVault to the newspaper.

One third of the reserve

China's central bank stated that in November they bought gold for the first time since 2019. A 32-ton gold reserve worth approximately SEK 19 billion. However, the gold industry believes that China's gold investment is probably higher.

Turkey has also increased its gold reserves. In the third quarter of this year, they bought 31 tons of gold, making it now a total of 29 percent of the national reserve, according to statistics from gold.org.

Russia has the second largest gold mining industry in the world, but after sanctions they have had problems selling the gold to other countries. In normal cases, they unearth approximately 300 tons of gold each year, of which 50 tons are exported.

Copying apartheid tactics

Adrian Ash believes that Russia has chosen to copy South Africa's tactics during the apartheid regime, when they also had extensive sanctions against them. This is by buying gold nationally, with domestic currency, and thus supporting domestic gold mining.

- With restrictions on the export side, it would be logical that it is the Russian central bank, says Giovanni Staunovo, commodity analyst at the financial company UBS to the Financial Times.

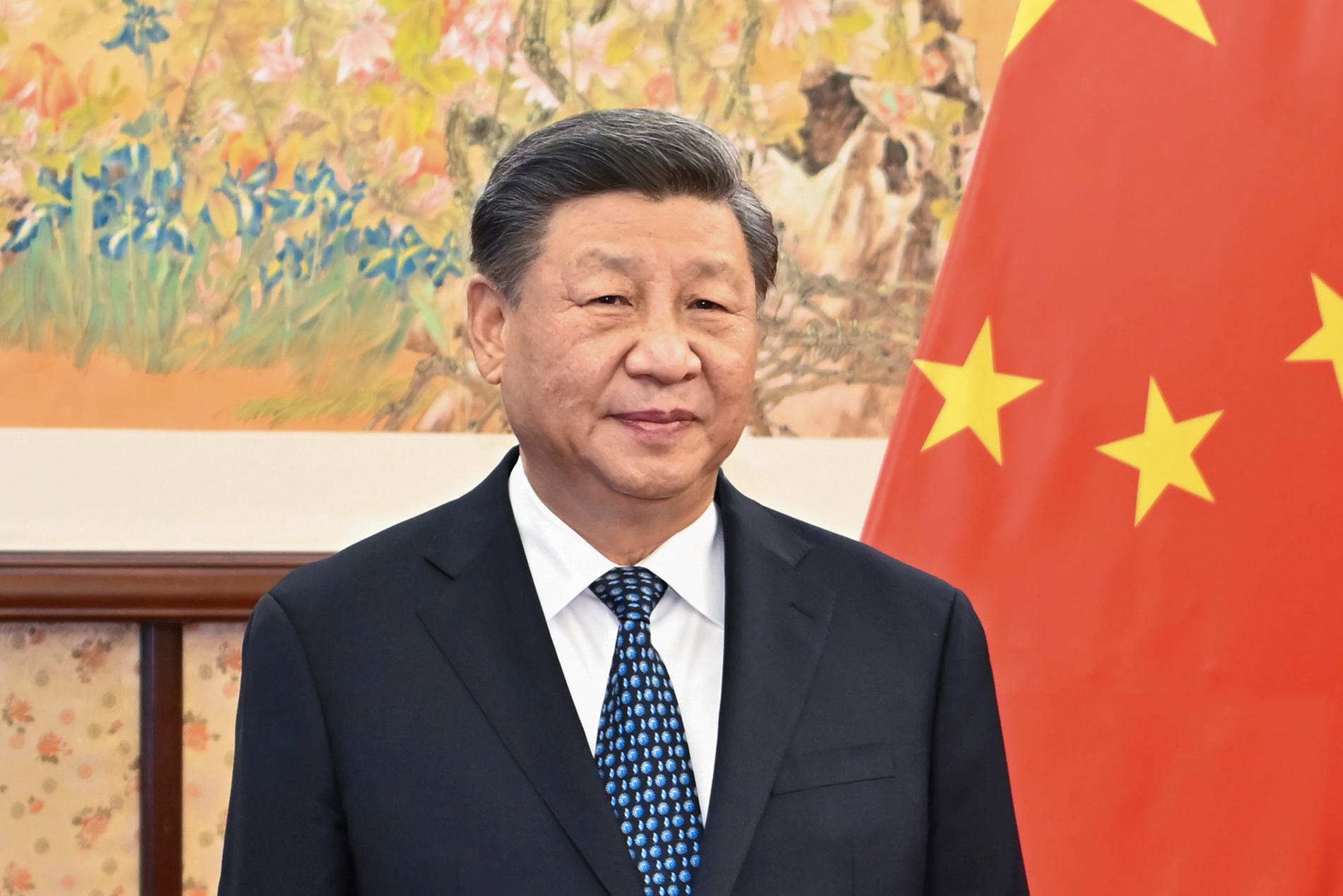

Xi Jinping. Photo: Li Tao/AP

Inga kommentarer:

Skicka en kommentar